colorado estate tax exemption 2021

Sales Tax Collection Part 7. Sales of gasoline dyed diesel and other exempt fuels Sales of exempt drugs and medical devices Bad debts charged-off returned goods trade discounts and allowances where tax as paid.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

A qualifying senior must be 65 years of age or older at the end of the income tax year for which the credit is claimed and have income that is less than or equal to 65000 adjusted for.

. For property tax years commencing on and after January 1 2021 the bill increases from 200000 to 300000 the maximum amount of actual value of the owner-occupied primary. The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of. 2021 Regular Session Subjects.

Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Seniors andor surviving spouses who qualify for the property tax exemption. Sep 28 2021 Legislative Resources.

Fees Timely filings with a 75 filing fee per report are due by April 15. County Treasurer List Abstract of Assessments Certification of Levies Forms Abatement Exemptions State Assessed Contact Division of Property Taxation 1313 Sherman St Room. In Colorado the median property tax rate is 505 per 100000 of assessed home value.

Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. Do you collect social security. For the 2021 tax year Colorado has a flat income tax rate of 45.

Sales Tax Licensing Part 6. Retail Sales Part 2. History of Senior Property Tax Exemption 2021.

Fifty percent of the first 200000 in actual property value is exempt from property taxation. The Colorado income tax of a nonresident estate or trust shall. For 2021 this amount is 117 million or 234 million for married couples.

The new law raises that exemption threshold to 50000 which means fewer businesses will have to pay this type of tax. Retailers Who Must Collect Tax Part 5. Taxable Sales Part 3.

175 for Applications for. Colorado Property Tax Breaks for Retirees. The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000 General Election.

The act allows counties municipalities and special districts to exempt up to 100 of business personal. Residents 65 and over may be eligible to. One Year Petition Writeable One Year Petition Legal Writeable One Year Petition Prints Letter Size Two Year Petition Writeable Two Year Petition Legal Writeable Two Year Petition Prints.

Does Colorado have estate tax 2021. Fiscal Policy Taxes. Estate tax can be applied at both the federal and state level.

Complete the Application for Sales Tax Exemption for Colorado Organizations DR 0715. Fiscal Policy Taxes Military Veterans Bill Summary The Colorado constitution allows a veteran who has a service-connected disability rated as a 100. Calculation of Tax Part 4.

The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. The following documents must be submitted with your application or it will.

State By State Estate And Inheritance Tax Rates Everplans

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Estate Tax Protection Colorado Wills And Estates

Historical Estate Tax Exemption Amounts And Tax Rates 2022

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

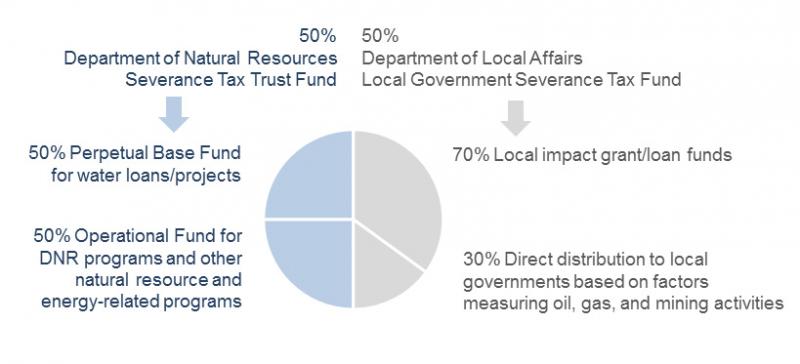

Severance Tax Colorado General Assembly

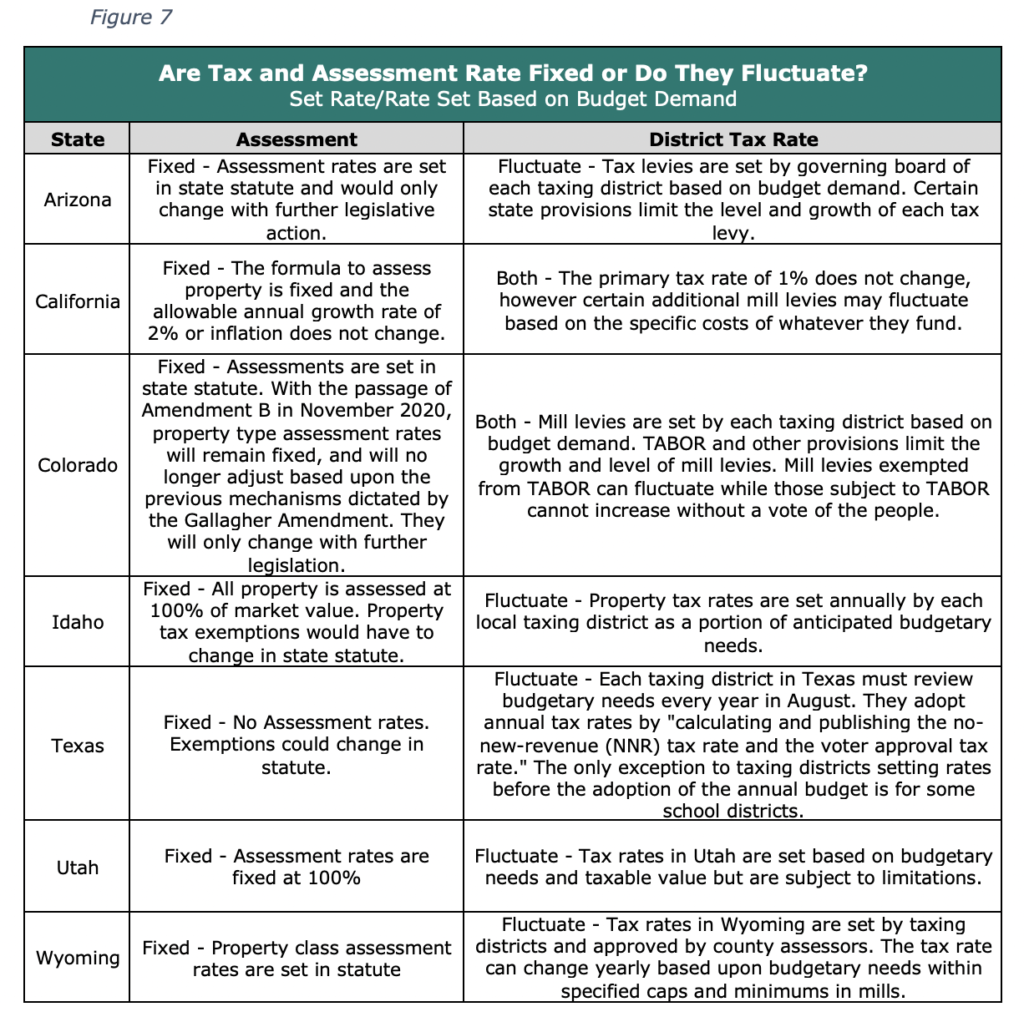

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Estate Tax Everything You Need To Know Smartasset

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

3 Ways Colorado Could Tax Wealth Colorado Fiscal Institute

Colorado Enacts Major Tax Changes Our Insights Plante Moran

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Colorado Property Tax Exemption For Seniors Colorado Gerontological Society

Orange Book Forms Colorado Estate Planning Forms Eighth Edition Includes 2018 2021 Updates Pdf Cle